Excitement About Custom Private Equity Asset Managers

Wiki Article

The 8-Minute Rule for Custom Private Equity Asset Managers

(PE): investing in firms that are not publicly traded. Roughly $11 (https://canvas.instructure.com/eportfolios/2568385/Home/Unlocking_Prosperity_Private_Investment_Opportunities_with_Custom_Private_Equity). There might be a couple of things you don't comprehend regarding the industry.

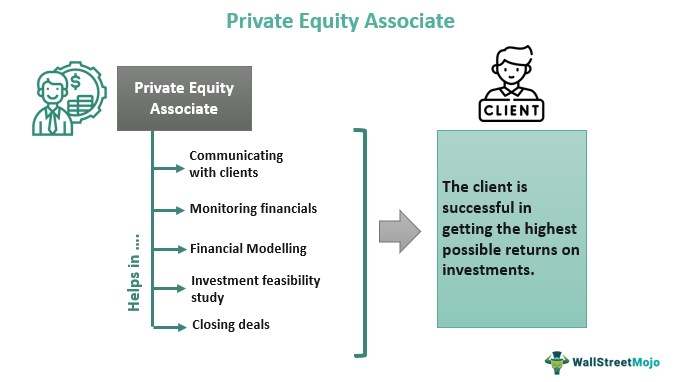

Partners at PE firms increase funds and take care of the cash to yield desirable returns for shareholders, generally with an investment perspective of in between four and 7 years. Exclusive equity companies have a range of investment preferences. Some are strict financiers or passive financiers entirely based on monitoring to grow the business and produce returns.

Since the very best gravitate toward the bigger bargains, the middle market is a considerably underserved market. There are more vendors than there are very skilled and well-positioned finance specialists with comprehensive customer networks and sources to handle a deal. The returns of exclusive equity are typically seen after a couple of years.

Custom Private Equity Asset Managers Things To Know Before You Buy

Flying below the radar of large international companies, a number of these little firms usually provide higher-quality client service and/or particular niche products and services that are not being supplied by the big corporations (https://pubhtml5.com/homepage/mzmjd/). Such advantages attract the interest of exclusive equity firms, as they possess the understandings and wise to exploit such opportunities and take the firm to the next degree

Many supervisors at portfolio business are given equity and bonus offer compensation frameworks that award them for striking their financial targets. Private equity possibilities are frequently out of reach for individuals that can't spend millions of bucks, but they shouldn't be.

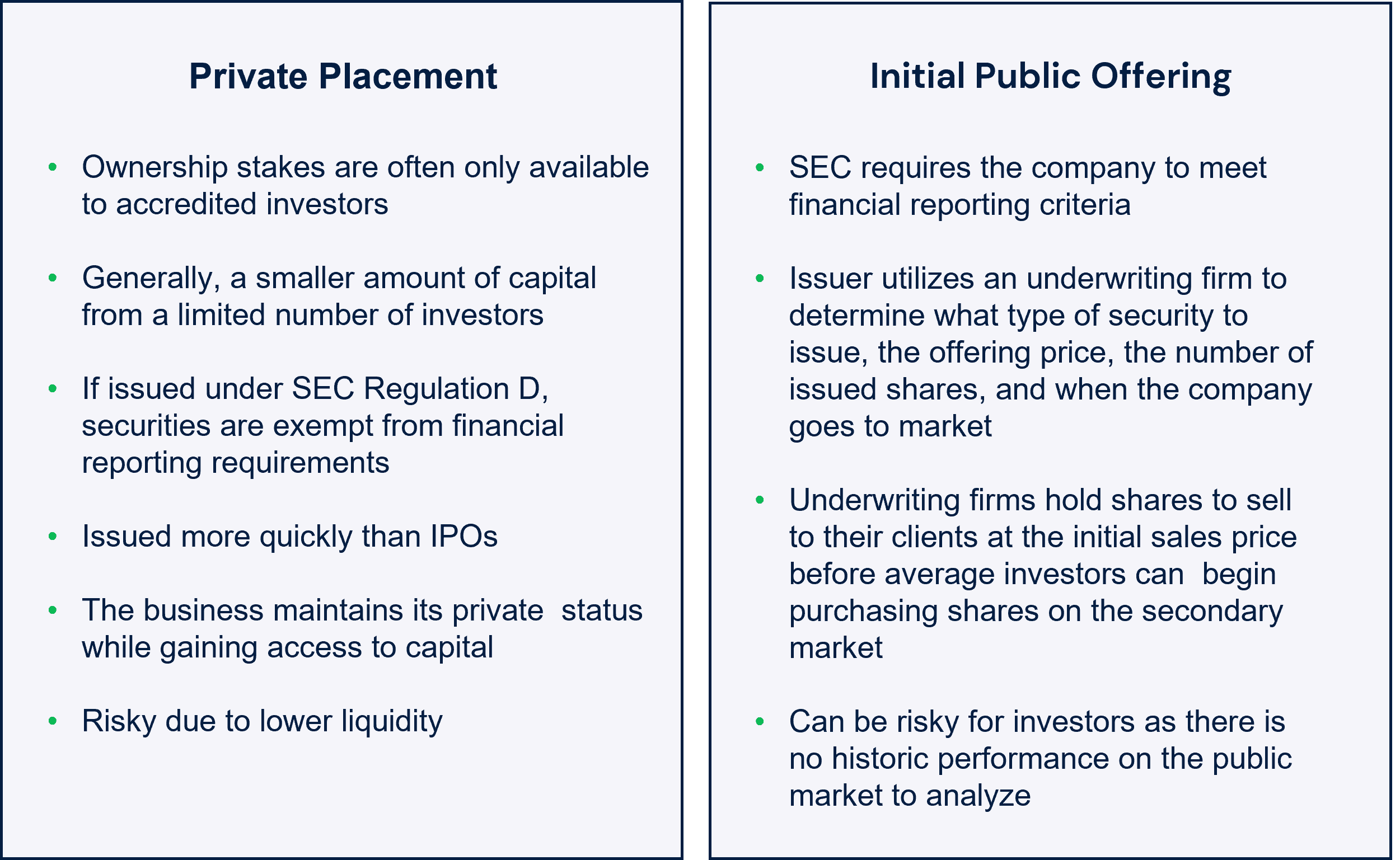

There are laws, such as limits on the accumulation quantity of cash and on the variety of non-accredited financiers. The exclusive equity business attracts a few of Private Equity Firm in Texas the very best and brightest in business America, including top entertainers from Lot of money 500 business and elite administration consulting companies. Legislation companies can also be recruiting grounds for personal equity employs, as accounting and lawful skills are required to total offers, and purchases are very searched for. https://www.viki.com/users/cpequityamtx/about.

Examine This Report about Custom Private Equity Asset Managers

One more drawback is the absence of liquidity; when in a private equity purchase, it is not simple to obtain out of or offer. With funds under administration currently in the trillions, private equity companies have come to be attractive financial investment cars for well-off individuals and institutions.

Now that access to personal equity is opening up to more individual financiers, the untapped capacity is coming to be a reality. We'll begin with the primary disagreements for investing in exclusive equity: Just how and why private equity returns have actually historically been higher than other assets on a number of degrees, Just how consisting of private equity in a portfolio affects the risk-return account, by aiding to expand versus market and intermittent danger, Then, we will detail some vital factors to consider and risks for exclusive equity investors.

When it concerns introducing a new property right into a profile, the many standard factor to consider is the risk-return account of that possession. Historically, personal equity has actually shown returns comparable to that of Arising Market Equities and greater than all various other traditional asset courses. Its reasonably reduced volatility paired with its high returns makes for an engaging risk-return account.

The 15-Second Trick For Custom Private Equity Asset Managers

Actually, personal equity fund quartiles have the widest array of returns across all different possession classes - as you can see below. Approach: Internal price of return (IRR) spreads out calculated for funds within classic years separately and after that balanced out. Mean IRR was calculated bytaking the average of the mean IRR for funds within each vintage year.

The takeaway is that fund choice is essential. At Moonfare, we perform a stringent selection and due persistance process for all funds listed on the platform. The impact of including exclusive equity right into a portfolio is - as constantly - depending on the portfolio itself. A Pantheon study from 2015 recommended that including exclusive equity in a portfolio of pure public equity can unlock 3.

On the various other hand, the most effective personal equity companies have accessibility to an even bigger pool of unidentified opportunities that do not deal with the very same scrutiny, in addition to the sources to perform due diligence on them and determine which deserve investing in (Private Investment Opportunities). Investing at the ground floor implies higher threat, however, for the companies that do succeed, the fund advantages from greater returns

7 Easy Facts About Custom Private Equity Asset Managers Described

Both public and personal equity fund managers dedicate to spending a percentage of the fund yet there remains a well-trodden issue with lining up passions for public equity fund monitoring: the 'principal-agent problem'. When a financier (the 'principal') works with a public fund supervisor to take control of their resources (as an 'agent') they delegate control to the manager while maintaining possession of the properties.

In the case of personal equity, the General Partner does not simply make a monitoring cost. They also earn a percentage of the fund's profits in the form of "carry" (usually 20%). This ensures that the interests of the manager are aligned with those of the capitalists. Personal equity funds also minimize an additional type of principal-agent issue.

A public equity investor inevitably desires one thing - for the administration to increase the supply cost and/or pay rewards. The investor has little to no control over the choice. We showed above the amount of personal equity techniques - particularly bulk buyouts - take control of the operating of the business, making certain that the long-term worth of the business comes first, rising the roi over the life of the fund.

Report this wiki page